Maximize Savings with Production Tax Credit Solar

Understanding the Basics: What is the Production Tax Credit for Solar?

Have you ever wondered how the sun can help save money? The production tax credit solar is a fantastic way to encourage the use of solar energy. It’s like getting a reward for choosing clean energy! This tax credit helps reduce the cost of producing solar power, making it more affordable for everyone.

Why Does It Matter?

- Saves Money: By lowering the cost of solar energy production, this credit helps reduce electricity bills.

- Encourages Clean Energy: It motivates more people to switch to solar, which is better for the environment.

- Supports Growth: More solar energy use means more jobs and innovation in the energy sector.

How Does It Work?

The production tax credit solar provides a financial incentive to solar energy producers. For every unit of solar energy they produce, they receive a tax credit, reducing their tax burden and making solar energy more competitive with traditional energy sources.

Benefits of the Production Tax Credit Solar

- Environmental Impact: Reduces carbon footprint and helps fight climate change.

- Economic Growth: Boosts the economy by creating jobs in the solar industry.

- Energy Independence: Reduces reliance on fossil fuels, promoting energy security.

In conclusion, the production tax credit solar is a powerful tool that not only makes solar energy more accessible but also supports a cleaner, greener future. By understanding and utilizing this credit, we can all contribute to a more sustainable world.

How the Production Tax Credit Solar Incentive Boosts Renewable Energy Adoption

Imagine a world where the sun not only lights up our days but also powers our homes and gadgets. This dream is becoming a reality thanks to the production tax credit solar incentive. This financial boost makes solar energy more affordable, encouraging more people to switch to this clean, renewable source of power.

What is the Production Tax Credit Solar?

The production tax credit solar acts like a special government coupon, reducing the cost of producing solar energy. This allows solar companies to offer lower prices, making it easier for families and businesses to choose solar power.

Benefits of the Solar Tax Credit

- Saves Money: Families and businesses can save on their energy bills.

- Environmentally Friendly: Solar energy reduces pollution and helps protect our planet.

- Job Creation: More solar projects mean more jobs in the renewable energy sector.

How Does It Work?

- Tax Savings: Solar companies receive a tax break, which they pass on to customers.

- Increased Adoption: Lower costs make solar energy more attractive.

- Long-term Benefits: Over time, more solar energy means less reliance on fossil fuels.

In conclusion, the production tax credit solar incentive is a powerful tool that helps more people embrace solar energy. By making solar power more affordable, it not only saves money but also supports a cleaner, greener future for everyone.

Maximizing Your Savings: How to Qualify for the Solar Production Tax Credit

Imagine transforming sunlight into savings with the production tax credit solar! This incentive not only helps you save money but also supports environmental sustainability. To qualify, you must own your solar energy system, meaning you need to purchase rather than lease your solar panels. This ownership is crucial as it makes you eligible for tax credits that can significantly lower your tax bill.

Key Eligibility Requirements

- Location: Your solar system must be installed in the United States.

- Installation Date: Ensure the system is operational by the end of the tax year.

- System Type: Verify with your installer that your solar system qualifies.

Essential Documentation

To claim your credit, gather necessary paperwork such as receipts, installation dates, and proof of ownership. Having these documents ready ensures a smooth process and maximizes your benefit from the production tax credit solar.

By following these steps, you can harness the power of solar energy while enjoying financial savings. It’s a win-win situation for both your wallet and the planet!

Curious about solar? Let us help you discover how solar energy can revolutionize your home and save you money. Request Your Free Solar Estimate at SOLAR ENERGY

The Economic Impact of Production Tax Credit Solar on Local Communities

Imagine a world where the sun not only brightens our day but also boosts our local economies. That’s the magic of production tax credit solar. This initiative encourages the use of solar energy by offering tax credits to producers, making solar power more affordable and accessible for everyone.

How It Benefits Local Economies

- Job Creation: Solar projects need workers, from engineers to installers, creating numerous job opportunities.

- Local Business Growth: As solar farms pop up, local businesses, like cafes and hardware stores, see more customers.

Environmental and Economic Harmony

When communities adopt solar energy, they not only help the planet but also save money. Lower energy costs mean families have more to spend on other things, boosting local businesses. Plus, using clean energy reduces pollution, making our air fresher and our communities healthier.

A Bright Future for All

The production tax credit solar doesn’t just help today; it sets the stage for a sustainable future. As more communities embrace solar power, they pave the way for a cleaner, more prosperous tomorrow. So, next time you see the sun shining, remember it’s not just lighting up our world—it’s powering our future.

Navigating the Application Process for Solar Production Tax Credits

The production tax credit solar offers a great opportunity to save money while promoting environmental sustainability. This credit provides financial incentives for using solar energy, effectively rewarding eco-friendly choices. But how can you apply for this credit? Let’s break down the process into simple steps.

Understand the Basics

First, grasp the essence of the production tax credit solar. It reduces your tax bill based on the solar energy you generate, acting as a financial bonus for going green.

Gather Necessary Documents

You’ll need to prepare some key documents:

- Proof of Solar Installation: Evidence of your solar panel setup.

- Energy Production Records: Documentation of your solar energy output.

- Tax Forms: Ensure you have the correct forms ready.

Complete the Application

With your documents in hand, follow these steps to apply:

- Fill Out the Form: Carefully complete all sections.

- Double-Check Details: Verify the accuracy of your information.

- Submit on Time: Ensure timely submission before the deadline.

Navigating the application for the production tax credit solar may seem daunting, but by following these steps, you can easily benefit from this program. Not only does it offer financial savings, but it also contributes to a healthier planet!

Future of Solar Energy: The Role of Production Tax Credits in Sustainable Development

Solar energy is like a superhero for our planet, helping us fight climate change and reduce pollution. But even superheroes need a little help sometimes. That’s where the production tax credit solar comes in. This financial incentive makes solar energy more affordable, encouraging more people and companies to use it.

What Are Production Tax Credits?

Production tax credits are like a reward for using clean energy. When companies produce electricity from solar panels, they get a tax break. This means they pay less money to the government, making solar energy cheaper and more attractive.

Benefits of Production Tax Credits

- Encourages Solar Adoption: More people and businesses choose solar energy because it’s more affordable.

- Boosts the Economy: Creates jobs in solar panel manufacturing and installation.

- Reduces Carbon Footprint: Less reliance on fossil fuels means cleaner air and a healthier planet.

The Future Looks Bright

With production tax credit solar, the future of energy is bright and sustainable. As more people switch to solar, we can expect cleaner cities and a healthier environment. This tax credit is a powerful tool in our journey toward a greener future.

Common Misconceptions About Production Tax Credit Solar Explained

The production tax credit solar is a hot topic in renewable energy, but it can be a bit confusing. This tax credit is crucial because it helps make solar energy more affordable, encouraging more people to switch to this clean energy source. However, there are some common misconceptions that can cloud our understanding.

Misconception 1: It’s Only for Big Companies

Many people think that the production tax credit solar is only for large corporations. In reality, this credit is available to a wide range of solar energy producers, including small businesses and even homeowners. This means that anyone investing in solar energy can benefit, making it more accessible to everyone.

Misconception 2: It’s a Complicated Process

Some believe that applying for the production tax credit solar is a daunting task. However, the process is more straightforward than it seems. With a little guidance, anyone can navigate the application process, ensuring they receive the financial benefits they deserve.

Misconception 3: It’s Not Worth the Effort

Another myth is that the savings from the production tax credit solar aren’t significant. In truth, these credits can lead to substantial savings over time, making solar energy a smart investment. By reducing upfront costs, the tax credit makes solar panels more affordable, encouraging more people to go green.

Harnessing Solar Power with SolarEnergy: Your Guide to Production Tax Credit Benefits

Embracing solar energy is a wise choice for both the planet and your finances. The production tax credit solar incentives significantly lower the cost of solar installations, making clean energy more accessible. This government incentive reduces taxes based on the electricity your solar panels produce, meaning more energy equals more savings.

What is the Production Tax Credit?

The production tax credit (PTC) encourages renewable energy use by offering tax reductions tied to your solar energy output. This incentive not only makes solar power more affordable but also promotes environmental sustainability.

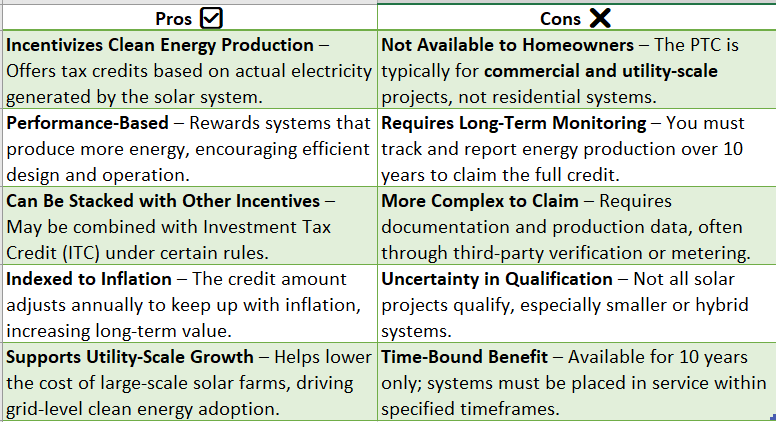

Benefits of the Production Tax Credit

- Cost Savings: Decrease your initial and ongoing energy expenses.

- Environmental Impact: Minimize your carbon footprint.

- Energy Independence: Produce your own electricity, reducing reliance on traditional power.

How to Qualify for the Production Tax Credit

- Install Solar Panels: Ensure eligibility for the PTC.

- Generate Electricity: Increase energy production for greater tax credits.

- File Your Taxes: Claim your benefits by including PTC information.

Understanding and leveraging the production tax credit solar benefits can positively impact your finances and the environment. SolarEnergy is committed to guiding you through your solar journey, ensuring you maximize these benefits.

FAQ

-

What is the Production Tax Credit (PTC) for solar energy?

The PTC is a federal incentive that offers a per-kilowatt-hour (kWh) tax credit for electricity generated by qualified solar systems. -

How much is the PTC for solar in 2024?

For projects meeting wage and apprenticeship rules, the 2024 PTC is about 2.75 cents per kWh produced. -

Who is eligible to claim the solar PTC?

Only commercial, utility-scale, or large-scale solar projects that begin construction before specific deadlines and meet IRS criteria. -

How long does the solar PTC last?

The PTC provides benefits for 10 years from the start of the system’s production. -

Can solar projects choose between the PTC and ITC?

Yes, solar project owners can choose either the PTC or the Investment Tax Credit (ITC), but not both.

Don’t wait to go solar! Thousands of homeowners are saving—join them and start reaping the benefits.

Book Your Free Consultation at SOLAR ENERGY

Explore additional solar solutions at NEW SOLAR QUOTES and discover how it can benefit your home!