Is There a Tax Credit for Solar Batteries?

Understanding Tax Credits for Solar Batteries

Investing in solar batteries can be more affordable thanks to available tax incentives. These credits are designed to promote renewable energy adoption, making solar power more accessible for homeowners and businesses. Is there a tax credit for solar batteries.

Federal Tax Credit

The federal government provides a solar Investment Tax Credit (ITC) applicable to both solar panels and batteries. This credit allows you to deduct a portion of your solar energy system’s installation costs from your federal taxes. As of 2023, the ITC covers 30% of these costs, including solar batteries, provided they are charged by solar panels. For instance, a $10,000 solar battery system could reduce your tax bill by $3,000.

State and Local Incentives

Beyond federal credits, many states offer additional incentives such as rebates, tax credits, or performance-based incentives. California’s Self-Generation Incentive Program (SGIP) is an example, offering rebates for solar battery installations to lower upfront costs. It’s crucial to consult your local government or utility provider to discover specific incentives available in your area.

Benefits of Tax Credits for Solar Batteries

- Cost Savings: Lowers the initial investment for solar battery systems.

- Energy Independence: Promotes renewable energy use, reducing grid reliance.

- Environmental Impact: Aids in transitioning to cleaner energy, decreasing carbon footprints.

By leveraging these tax credits, you can achieve both financial savings and environmental benefits, making solar batteries a compelling choice for a sustainable future.

Eligibility Criteria for Solar Battery Tax Credits

Are you curious about whether there’s a tax credit for solar batteries? The answer is a resounding yes! However, to fully benefit, it’s essential to understand the eligibility criteria. Here’s what you need to know.

To qualify for the federal solar tax credit, also known as the Investment Tax Credit (ITC), your solar battery must meet certain conditions:

- Integration with Solar Panels: The battery must be charged by solar energy, meaning it should be part of a solar energy system rather than a standalone unit.

- Installation Date: The system must be installed and operational within the tax year you wish to claim the credit.

- Ownership: You must own the solar battery system, as leased systems do not qualify.

For instance, if you installed a solar battery system in 2023, you could claim the tax credit on your 2023 tax return, potentially reducing your tax liability and making solar energy more affordable.

Consider Jane, a homeowner in California, who installed a solar battery system last year. By meeting the eligibility criteria, she claimed a significant tax credit, lowering her costs and boosting her home’s energy efficiency.

In conclusion, while there is a tax credit for solar batteries, meeting the eligibility criteria is vital. Doing so allows you to reap both financial and environmental rewards from solar energy.

How to Apply for Solar Battery Tax Credits

If you’re thinking about adding solar batteries to your home, you might ask, “Is there a tax credit for solar batteries?” Fortunately, the answer is yes! The federal government provides a tax credit for solar energy systems, including batteries, which can significantly lower your investment costs.

Understanding the Tax Credit

The federal solar tax credit, known as the Investment Tax Credit (ITC), lets you deduct a portion of your solar system’s cost from your federal taxes. As of 2023, this credit covers up to 30% of the total cost, including solar panels and batteries. For instance, if your system costs $10,000, you could save $3,000 on taxes.

Curious about solar? Let us help you discover how solar energy can revolutionize your home and save you money. Request Your Free Solar Estimate at SOLAR ENERGY

Steps to Apply for the Tax Credit

Applying for the solar battery tax credit is simple:

- Install Your Solar System: Ensure your system is installed and operational. Keep all related receipts and documentation.

- Complete IRS Form 5695: Use this form to claim the Residential Energy Efficient Property Credit.

- File Your Taxes: Include Form 5695 with your tax return to reduce your tax liability.

Benefits of Solar Battery Tax Credits

- Cost Savings: Lowers upfront costs.

- Energy Independence: Reduces grid reliance.

- Environmental Impact: Supports cleaner energy solutions.

By leveraging the solar battery tax credit, you save money and support a sustainable future. Now is the perfect time to harness solar power!

Federal Tax Incentives for Solar Battery Installation

Considering solar batteries for your home energy system? You’re likely curious about financial benefits, including tax credits. Fortunately, the federal government offers incentives to make this investment more affordable. The Federal Investment Tax Credit (ITC) is a key incentive for homeowners installing solar systems, including batteries. As of 2023, the ITC allows a 30% deduction of the installation cost from federal taxes, covering both solar panels and batteries.

Benefits of the ITC for Solar Batteries:

- Cost Savings: The ITC reduces tax liability, lowering the overall cost of installation.

- Energy Independence: Store excess energy for use at night or during outages.

- Environmental Impact: Reduces reliance on fossil fuels, promoting a cleaner environment.

To leverage this tax credit, ensure your solar battery system meets IRS eligibility criteria, typically requiring new installations in primary or secondary residences. Note that the ITC is set to decrease in the future, so acting soon could maximize savings.

Real-world examples illustrate the financial impact. A California homeowner installing a $20,000 solar battery system could save $6,000 through the ITC, significantly reducing upfront costs. Thus, solar batteries are not only sustainable but also financially wise.

In summary, while initial investments in solar batteries can be high, federal tax incentives like the ITC make them more accessible and appealing, offering both immediate and long-term benefits for energy efficiency and environmental friendliness.

State-Level Tax Credits for Solar Batteries

Switching to solar energy often prompts the question, “Is there a tax credit for solar batteries?” While federal incentives are widely recognized, state-level tax credits can further enhance the financial appeal of installing solar batteries. These incentives vary by state and may include tax credits, rebates, or grants. For example, California’s Self-Generation Incentive Program (SGIP) offers rebates for battery storage systems, making solar technology more accessible.

Key Benefits of State-Level Tax Credits

- Cost Reduction: These credits can significantly decrease the initial cost of installing solar batteries.

- Increased Savings: By leveraging both state and federal incentives, homeowners can optimize their financial savings.

- Energy Independence: Lower costs enable more homeowners to invest in solar batteries, fostering greater energy independence.

Illustrative Example

Take a New York homeowner installing a solar battery system. They might benefit from the state’s Solar Equipment Tax Credit, which covers up to 25% of the system’s cost, capped at $5,000. Coupled with federal incentives, this can substantially reduce expenses, motivating more individuals to embrace clean energy.

Navigating state-level tax credits for solar batteries can be complex, but the financial and environmental advantages make it worthwhile. It’s advisable to consult local energy offices or a tax professional to understand the specific incentives available in your area.

Maximizing Savings with Solar Battery Tax Credits

Switching to solar energy is not only eco-friendly but also financially savvy, especially with the availability of solar battery tax credits. While many are familiar with tax incentives for solar panels, fewer realize these benefits extend to solar batteries.

Understanding the Tax Credit Landscape

The federal solar investment tax credit (ITC) can significantly lower the cost of installing solar systems, including batteries. As of 2023, homeowners can claim a tax credit of up to 30% of their solar battery installation costs. For instance, a $10,000 solar battery system could yield a $3,000 tax credit.

Why Consider Solar Battery Tax Credits?

- Cost Savings: Tax credits reduce installation costs, making solar batteries more affordable.

- Energy Independence: Store excess energy for use during peak hours or outages, reducing grid reliance.

- Environmental Impact: Maximize renewable energy use, contributing to a greener planet.

Real-World Example

Jane, a California homeowner, installed a solar battery system alongside her solar panels. By leveraging the 30% tax credit, she significantly cut installation costs, enjoying lower electricity bills and contributing to sustainability.

Steps to Claim Your Tax Credit

- Consult a Tax Professional: Understand how the credit applies to you.

- Keep Detailed Records: Save all purchase and installation documentation.

- File IRS Form 5695: Use this form to claim your residential energy credits.

Understanding and utilizing solar battery tax credits can enhance your home’s energy future while offering substantial savings.

Common Misconceptions About Solar Battery Tax Credits

Many homeowners are interested in the financial incentives for solar energy, particularly tax credits for solar batteries. However, misconceptions often arise. Let’s clarify these points.

A prevalent misunderstanding is that solar battery tax credits are universally available. While the federal government does offer a tax credit for solar energy systems, including batteries, the details can differ. The Federal Investment Tax Credit (ITC) allows homeowners to deduct a portion of the installation cost of a solar energy system from their federal taxes. As of 2023, this credit is 30% and includes solar batteries when installed with solar panels.

However, state incentives for solar batteries are not uniform. Some states have their own programs offering additional financial benefits, but these vary significantly. For instance, California’s Self-Generation Incentive Program (SGIP) provides rebates for battery storage systems, making them more affordable for residents. It’s important to research local incentives to fully understand potential savings.

Key Points to Consider:

- Federal Tax Credit: Available for solar systems, including batteries, when installed together.

- State Incentives: Vary by location; some states offer additional rebates or credits.

- Eligibility Requirements: Ensure your installation meets criteria for both federal and state programs.

In summary, while tax credits for solar batteries exist, understanding federal and state programs is crucial for maximizing savings on solar energy investments.

Future of Tax Credits for Solar Battery Systems

As renewable energy gains momentum, homeowners are increasingly interested in the financial incentives for adopting solar technology, particularly tax credits for solar batteries. Fortunately, tax credits are available, significantly enhancing the affordability and appeal of solar battery systems.

Current Tax Credits

The federal government currently offers the Investment Tax Credit (ITC), which allows homeowners to deduct a substantial portion of the cost of installing a solar energy system, including solar batteries, from their federal taxes. Key details include:

- Percentage Deduction: The ITC currently offers a 30% deduction, providing considerable savings.

- Eligibility: To qualify, the solar battery must be charged by the connected solar panels.

- Timeline: These credits are scheduled to decrease in the future, so acting promptly can maximize benefits.

Real-World Impact

Take the Johnson family, for example, who installed a solar panel system with a battery in 2022. By utilizing the ITC, they saved thousands on installation costs, making their shift to renewable energy financially feasible. This not only reduced their carbon footprint but also ensured energy independence during outages.

Looking Ahead

The outlook for tax credits for solar battery systems is promising, with discussions about extending and expanding these incentives. As more states acknowledge the advantages of solar energy, additional local incentives may emerge. Staying informed about these developments can help homeowners make strategic decisions that benefit both their finances and the environment.

Expert Tips on Claiming Solar Battery Tax Credits

Thinking about adding solar batteries to your home energy system? You might be pleased to know there’s a tax credit available to help offset the cost. The federal Investment Tax Credit (ITC) offers a significant financial incentive for installing solar energy systems, including batteries, making it a wise investment for both your finances and the environment.

Understanding the Tax Credit

The ITC allows you to deduct a portion of your solar energy system installation costs from your federal taxes. As of 2023, this credit covers 30% of the installation costs for solar panels and batteries. For instance, if your solar battery installation costs $10,000, you could reduce your tax bill by $3,000, making the transition to green energy more affordable.

Steps to Claim Your Credit

To maximize your benefits, consider these steps:

- Consult a Tax Professional: Speak with a tax advisor to understand how the credit applies to your situation.

- Keep Detailed Records: Save all receipts and documentation related to your solar battery purchase and installation.

- File IRS Form 5695: Use this form to claim the Residential Energy Efficient Property Credit, ensuring it’s filled out correctly.

Real-World Example

Take Jane, a California homeowner who installed a solar battery system in 2022. By claiming the ITC, she significantly reduced her tax liability, making her investment more affordable. Jane’s story underscores the importance of understanding and utilizing tax credits to make sustainable energy solutions financially viable.

FAQ

-

Is there a tax credit for solar batteries?

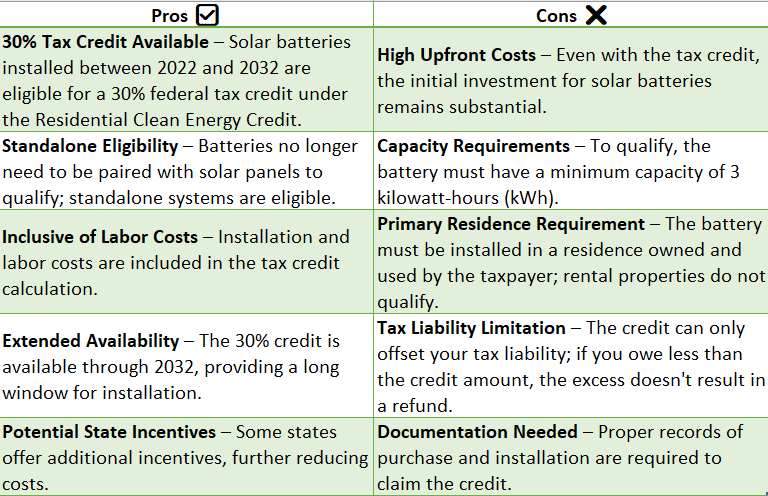

Yes, the federal Residential Clean Energy Credit offers a 30% tax credit for eligible solar battery installations. -

Do I need solar panels to claim the battery tax credit?

No, starting in 2023, stand-alone batteries with at least 3 kWh capacity also qualify. -

Can I get a credit for adding a battery to my existing solar system?

Yes, as long as the battery is charged only by solar energy, you can still qualify. -

What costs are included in the solar battery tax credit?

The credit can cover the battery, installation, wiring, and associated hardware costs. -

When does the 30% tax credit expire?

The 30% credit is available through 2032, then gradually decreases unless extended by new legislation.

Don’t wait to go solar! Thousands of homeowners are saving—join them and start reaping the benefits.

Book Your Free Consultation at SOLAR ENERGY

Explore additional solar solutions at NEW SOLAR QUOTES and discover how it can benefit your home!