Do Solar Batteries Qualify for Tax Credits?

Understanding Solar Battery Tax Credits: What You Need to Know

If you’re considering solar batteries for your home, you might wonder if they qualify for tax credits. The answer is yes, making them an attractive investment for those embracing renewable energy. Solar batteries, when paired with a solar panel system, are eligible for the federal solar tax credit, known as the Investment Tax Credit (ITC). This allows you to deduct a percentage of your solar installation costs from federal taxes. As of 2023, the ITC offers a 30% credit, significantly reducing your solar investment costs.

Benefits of Solar Battery Tax Credits:

- Cost Savings: The ITC reduces your tax liability, lowering the upfront cost of solar batteries.

- Energy Independence: Store excess energy for peak times or outages, boosting energy independence.

- Environmental Impact: Support renewable energy, reducing carbon emissions and promoting a cleaner environment.

Example: A homeowner installing a $20,000 solar system with batteries could save $6,000 with the 30% ITC, making the investment more affordable.

Claiming Your Tax Credit:

- Install a Qualifying System: Ensure your system meets ITC requirements.

- Keep Records: Save all installation receipts and documentation.

- File IRS Form 5695: Claim your Residential Energy Credits when filing taxes.

In summary, solar batteries enhance energy efficiency and qualify for tax credits, making them a smart choice for eco-conscious homeowners.

Do Solar Batteries Qualify for Tax Credits in 2023?

In 2025, solar batteries indeed qualify for tax credits, thanks to the federal Investment Tax Credit (ITC). This incentive allows homeowners to deduct a portion of their solar energy system costs, including batteries, from their federal taxes. Specifically, the ITC covers up to 30% of the installation costs, meaning a $10,000 investment in solar batteries could reduce your tax bill by $3,000. This makes adopting solar energy not only environmentally friendly but also financially appealing.

The benefits of the solar tax credit are substantial:

- Cost Savings: Significantly lowers the cost of solar battery installation.

- Environmental Impact: Promotes clean energy use, reducing carbon emissions.

- Energy Independence: Offers a dependable backup during power outages.

To qualify, ensure your solar battery system is installed alongside solar panels and used to power your home. Keeping all installation receipts and documentation is crucial for tax filing. Consulting a tax professional can help you maximize these savings. By leveraging these tax credits, you contribute to a sustainable future while enjoying immediate financial benefits.

Curious about solar? Let us help you discover how solar energy can revolutionize your home and save you money. Request Your Free Solar Estimate at SOLAR ENERGY

How to Determine Eligibility for Solar Battery Tax Credits

Understanding whether solar batteries qualify for tax credits can significantly influence your decision to invest in solar energy storage. The good news is that solar batteries can indeed qualify for tax credits, but certain conditions must be met. To be eligible, your solar battery system must be charged primarily by renewable energy sources, such as solar panels. If your battery relies mostly on grid power, it might not qualify. However, when integrated into a larger solar energy system, it can often be included in the federal solar tax credit, known as the Investment Tax Credit (ITC).

To determine eligibility, consider the following:

- Integration with Solar Panels: Ensure your battery is part of a solar panel system.

- Percentage of Solar Charging: The battery should be charged by solar energy at least 75% of the time.

- Installation Date: Be aware that the ITC percentage decreases over time.

For example, a homeowner in California installed a solar panel system with a battery backup, ensuring it was primarily solar-charged. This allowed them to claim the ITC, significantly reducing installation costs and enhancing energy efficiency. By meeting these criteria, you can maximize financial incentives, benefiting both your wallet and the environment.

Maximizing Your Savings: Solar Battery Tax Credit Benefits

Investing in solar energy offers dual benefits: environmental sustainability and financial savings. A significant incentive for homeowners is the federal tax credit, which also applies to solar batteries. This makes solar batteries a more appealing option for those aiming to maximize energy savings.

Why Consider Solar Batteries?

Solar batteries store excess energy from solar panels, providing power during non-sunny periods. This not only boosts energy independence but also cuts down on grid reliance, enhancing savings. The federal tax credit helps reduce the initial cost, making solar batteries more accessible.

Benefits of the Solar Battery Tax Credit:

- Reduced Upfront Costs: The tax credit lowers the initial investment for solar batteries.

- Increased Home Value: Homes with solar systems and batteries often see a rise in property value.

- Energy Independence: Storing energy reduces utility dependency and shields against rising costs.

Real-World Example:

The Johnson family installed a solar system with battery storage in 2022, utilizing the federal tax credit to cover 30% of their costs. This made the project affordable and led to substantial monthly energy savings. They now enjoy a sustainable lifestyle with greater energy control.

In summary, solar batteries, supported by tax credits, offer significant financial and environmental benefits, making them a smart choice for homeowners.

Step-by-Step Guide to Claiming Solar Battery Tax Credits

Wondering if solar batteries qualify for tax credits? The answer is a resounding yes! Thanks to the federal solar tax credit, or Investment Tax Credit (ITC), you can claim a portion of your solar battery costs on your taxes. This credit allows you to deduct a percentage of your solar energy system installation costs, including solar batteries, from your federal taxes. For installations in 2023, the credit is 30%, meaning a $10,000 installation could reduce your tax bill by $3,000.

Steps to Claim Your Tax Credit

- Install a Qualifying System: Ensure professional installation and compliance with necessary criteria.

- Keep Detailed Records: Maintain all receipts and documentation related to your purchase and installation.

- File IRS Form 5695: Use this form to claim your Residential Energy Credits during tax season.

- Consult a Tax Professional: Seek guidance to maximize benefits and ensure compliance.

Consider Sarah, a Californian homeowner who installed a solar battery system in 2023 for $15,000. By claiming the 30% tax credit, she reduced her tax liability by $4,500, making her renewable energy investment more affordable. Following these steps can make your transition to renewable energy both financially and environmentally rewarding.

Common Misconceptions About Solar Battery Tax Credits

Many homeowners are curious about the financial incentives available for solar energy, particularly tax credits. A frequent question is whether solar batteries qualify for these credits. Let’s clarify this topic.

Solar batteries can qualify for tax credits under specific conditions. The federal solar tax credit, known as the Investment Tax Credit (ITC), allows homeowners to deduct a percentage of the cost of installing a solar energy system from their federal taxes. This includes solar panels and, often, solar batteries, as long as they are part of the overall solar energy system.

Key Points to Consider:

- Integration Requirement: Solar batteries must be integrated with a solar panel system to qualify for the ITC. Standalone batteries do not qualify.

- Percentage Deduction: The ITC offers a 30% deduction as of 2023, significantly reducing the cost of solar investments.

- Installation Timing: The tax credit is available for systems installed before the end of 2032, making it an opportune time to invest.

For example, a California homeowner installed a solar panel system with a battery backup and claimed the ITC, reducing their tax liability by thousands. This made the investment more affordable and provided peace of mind during power outages. Understanding these nuances helps homeowners make informed decisions and maximize savings.

State vs. Federal Tax Credits for Solar Batteries

Solar batteries offer enticing tax credit opportunities, but understanding the nuances between state and federal levels is crucial. Federal Tax Credits provide the Investment Tax Credit (ITC), allowing deductions of up to 30% of solar battery installation costs from federal taxes as of 2023. This incentive is substantial for both homeowners and businesses, provided the battery is charged by solar energy, ensuring eco-friendliness and cost-effectiveness.

On the other hand, State Tax Credits vary significantly. Some states offer additional credits or rebates, further reducing installation costs. For instance, California’s Self-Generation Incentive Program (SGIP) provides rebates for energy storage systems, enhancing affordability. It’s vital to explore your state’s specific programs, as they can greatly influence your savings.

Incorporating solar batteries not only contributes to a sustainable future but also offers financial benefits through these tax credits. By understanding and leveraging both federal and state incentives, you can optimize your savings and enjoy the long-term benefits of renewable energy solutions. This strategic approach ensures you make informed decisions while supporting environmental sustainability.

The Future of Solar Battery Tax Credits: Trends and Predictions

As the shift towards renewable energy accelerates, solar batteries have become increasingly significant, particularly concerning tax credits. Yes, solar batteries do qualify for tax credits, specifically under the federal solar tax credit, also known as the Investment Tax Credit (ITC). This allows homeowners to deduct a portion of the cost of installing a solar energy system, including batteries, from their federal taxes.

Current Trends

Solar batteries are essential for sustainable energy systems, not just as backup power. The demand for solar batteries is rising due to their role in energy independence. Technological advancements are making solar storage more efficient and affordable, while evolving government policies support their integration into the grid.

Predictions for the Future

The future of solar battery tax credits is promising. We might see extended incentives as renewable energy initiatives grow, with potential expansions of current tax credits. States could introduce their own incentives, enhancing accessibility. As awareness of the financial and environmental benefits increases, solar battery adoption is expected to rise.

In summary, understanding the evolving landscape of solar battery tax credits is crucial for maximizing benefits, whether you’re a homeowner or a business aiming to reduce energy costs and carbon footprint.

How Solar Battery Tax Credits Impact Your Investment

Investing in solar energy is a smart financial move, and understanding solar battery tax credits can enhance this investment. The federal solar tax credit, or Investment Tax Credit (ITC), allows deductions from federal taxes for solar energy system installations, including solar batteries when part of a solar panel system. This makes solar energy more affordable and appealing by reducing tax liabilities.

Key Benefits

- Cost Savings: Tax credits lower the initial cost of solar battery installations, making solar energy more accessible.

- Energy Independence: Solar batteries store excess energy for later use, decreasing reliance on the grid.

- Increased Property Value: Properties with solar systems, including batteries, often see a rise in value.

Example of Savings

A homeowner installing a $20,000 solar panel system with a battery could save $5,200 on federal taxes with a 26% ITC rate, making the investment more attractive.

Steps to Claim Your Credit

- Install a Qualifying System: Ensure the battery is part of a solar panel system.

- Keep Documentation: Retain all related receipts and contracts.

- File IRS Form 5695: Use this form to claim Residential Energy Credits.

Understanding these credits helps maximize your renewable energy investment, offering significant savings and promoting sustainability.

Comparing Solar Battery Tax Credits with Other Renewable Incentives

Solar batteries are increasingly popular for their environmental and financial benefits, including eligibility for tax credits. Yes, solar batteries do qualify for tax credits, making them an attractive option for homeowners looking to reduce energy costs.

Key Tax Credits for Solar Batteries:

- Federal Investment Tax Credit (ITC): Solar batteries qualify if charged by solar energy over 75% of the time, allowing homeowners to deduct a portion of installation costs from federal taxes.

- State and Local Incentives: Additional credits or rebates are available in many states, further lowering costs.

Comparison with Other Renewable Incentives:

- Wind Energy Credits: These also qualify for federal tax credits but require more space and specific conditions, making solar more accessible.

- Geothermal Heat Pumps: While eligible for tax credits, they involve more complex installations than solar batteries.

In states like California, robust incentives have led many homeowners to combine solar panels with battery storage, significantly reducing energy bills and enhancing returns on investment. Ultimately, while solar batteries qualify for tax credits, it’s crucial to consider the broader landscape of renewable incentives to tailor energy solutions to your financial and environmental goals.

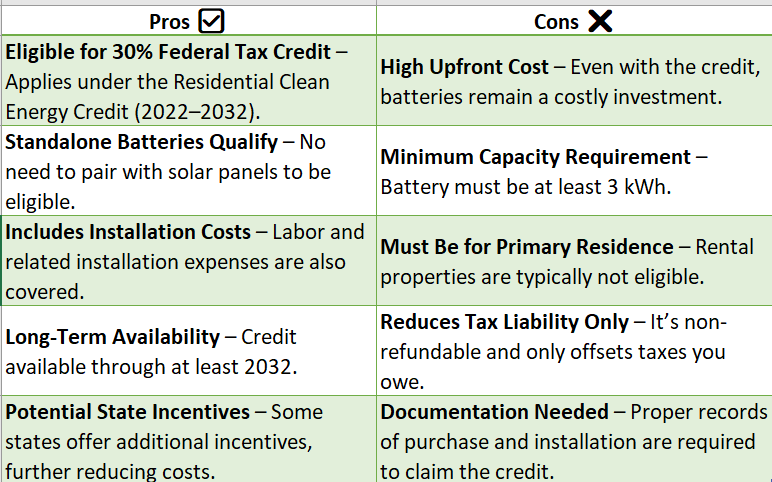

FAQ

-

Do solar batteries qualify for tax credits?

Yes, solar batteries are eligible for the federal Residential Clean Energy Credit. -

How much is the solar battery tax credit?

You can claim 30% of the total cost, including installation. -

Can I claim the credit if I already have solar panels?

Yes, if your battery is charged only by solar power. -

Do stand-alone solar batteries qualify?

Yes, as of 2023, batteries with a capacity of at least 3 kWh qualify even without solar panels. -

Is the tax credit available in all states?

The federal tax credit applies nationwide, but some states offer additional incentives.

Don’t wait to go solar! Thousands of homeowners are saving—join them and start reaping the benefits.

Book Your Free Consultation at SOLAR ENERGY

Explore additional solar solutions at NEW SOLAR QUOTES and discover how it can benefit your home!