Boost Savings with Production Tax Credit Solar

Understanding the Basics of Production Tax Credit for Solar Energy

Navigating solar energy incentives can be complex, but the Production Tax Credit (PTC) for solar energy offers a significant financial advantage for individuals and businesses. The PTC is a federal incentive that rewards solar energy producers based on the electricity they generate. Unlike one-time tax deductions, the PTC provides ongoing benefits, making it particularly appealing for large-scale solar projects. Essentially, the more energy your solar panels produce, the more you save on taxes.

Key Benefits of the Production Tax Credit:

- Long-term Savings: Offers a per-kilowatt-hour (kWh) credit for electricity generated, reducing tax liabilities over time.

- Encourages Renewable Energy Growth: Incentivizes production, driving the expansion of solar energy infrastructure.

- Supports Economic Development: Increased solar production can lead to job creation and economic growth in local communities.

A solar farm in Arizona exemplifies the PTC’s impact by using it to offset initial investment costs. By maximizing energy output, they reduced their tax burden and reinvested savings into expanding operations, showcasing the PTC as a game-changer for solar energy producers.

In conclusion, understanding the PTC for solar energy is crucial for renewable energy investments. It provides ongoing financial incentives, making solar projects more viable and contributing to a greener future. Whether you’re a homeowner or a business owner, utilizing this credit can lead to substantial savings and a positive environmental impact.

How Production Tax Credit Solar Incentives Benefit Homeowners

Switching to solar energy is a financially wise decision, particularly with the production tax credit (PTC) solar incentives. These incentives make solar energy more accessible and affordable, offering significant savings on energy bills while promoting environmental sustainability.

The PTC provides a dollar-for-dollar reduction in federal income taxes for each kilowatt-hour of electricity your solar system generates. This means greater energy production leads to more savings. Homeowners benefit in several ways:

- Cost Savings: The PTC reduces tax liability, effectively lowering the overall cost of solar installation, making the initial investment more feasible and speeding up the return on investment.

- Increased Home Value: Solar-equipped homes often see a rise in property value, as energy-efficient homes are increasingly desirable to buyers.

- Environmental Impact: Generating clean energy helps reduce carbon emissions, contributing to climate change mitigation.

Take, for instance, a family in Arizona who installed a solar system last year. With the PTC, they reduced their annual tax bill and saw a 20% decrease in monthly energy costs. Over time, these savings accumulate, making solar a smart financial choice.

Investing in solar energy is not just about cost savings; it’s about contributing to a sustainable future. The production tax credit provides a compelling incentive for homeowners to transition to solar, offering both immediate and long-term benefits.

The Impact of Production Tax Credit on Solar Industry Growth

The Production Tax Credit (PTC) has significantly influenced the solar industry by promoting growth and innovation. This federal incentive provides a per-kilowatt-hour tax credit for electricity generated by qualified energy resources, effectively reducing the financial burden on solar energy producers. As a result, it has become more feasible for companies to invest in solar projects, leading to a notable increase in solar installations nationwide. For example, states like California and Texas have experienced a substantial rise in solar farms, thanks to the financial relief offered by the PTC.

Additionally, the PTC has encouraged innovation within the industry. By lowering costs, companies can invest more in research and development, resulting in technological advancements in solar energy.

The PTC offers several key benefits:

- Increased investment in solar infrastructure

- Job creation within the renewable energy sector

- Enhanced competitiveness of solar energy against fossil fuels

In summary, the Production Tax Credit has not only driven growth in the solar industry but also set the stage for a more sustainable future. As more states and companies adopt this incentive, the potential for solar energy to become a leading power source continues to expand.

Eligibility Criteria for Production Tax Credit in Solar Projects

Understanding the eligibility criteria for the Production Tax Credit (PTC) is crucial for enhancing the financial viability of solar projects. The PTC is a federal incentive designed to promote renewable energy development, including solar projects. To qualify, your solar project must meet certain conditions.

Firstly, the project must be located within the United States and generate electricity from solar energy. Additionally, it is essential that the construction of the project begins by a deadline set by the IRS, which is subject to periodic updates. Staying informed about these deadlines is vital to ensure eligibility.

Key Eligibility Points:

- Location: The project must be based in the United States.

- Construction Start Date: Projects must start construction by the IRS-specified deadline.

- Type of Energy: The project must utilize solar technology to generate electricity.

Real-world examples, such as a solar farm in Arizona, illustrate the significance of these criteria. By commencing construction before the deadline, the project successfully secured the PTC, thereby reducing costs significantly. This highlights the importance of timing and adherence to IRS guidelines.

By aligning your project with these eligibility requirements, you can maximize the financial benefits of the PTC, making your solar investment more sustainable and profitable.

Curious about solar? Let us help you discover how solar energy can revolutionize your home and save you money. Request Your Free Solar Estimate at SOLAR ENERGY

Steps to Apply for Production Tax Credit in Solar Installations

Understanding the Production Tax Credit (PTC) for solar installations can significantly ease the financial load of solar projects, making them more appealing. Here’s a concise guide to applying for this beneficial credit.

Start by confirming your eligibility. The PTC is generally available for commercial solar projects, so business owners and developers should check if their projects meet the criteria, such as being U.S.-based and using qualified solar equipment.

Next, gather all necessary documentation. This includes project plans, financial projections, and proof of equipment purchase. Organizing these documents will simplify the application process.

Here’s a streamlined checklist:

- Verify Eligibility: Ensure your project qualifies for the PTC.

- Gather Documentation: Assemble all required paperwork, including project plans and financial details.

- Submit Application: Complete and submit the application to the appropriate authorities.

- Follow Up: Maintain communication with the agency to ensure smooth processing.

Real-world examples, like a solar farm in Texas, show how the PTC can offset initial costs, leading to significant savings and faster returns on investment. Such success stories highlight the importance of utilizing available incentives to maximize financial benefits.

In summary, applying for the PTC involves strategic steps, but the potential savings make it worthwhile. By confirming eligibility, organizing documentation, and diligently following the application process, you can unlock substantial financial advantages for your solar project.

Comparing Production Tax Credit with Other Solar Incentives

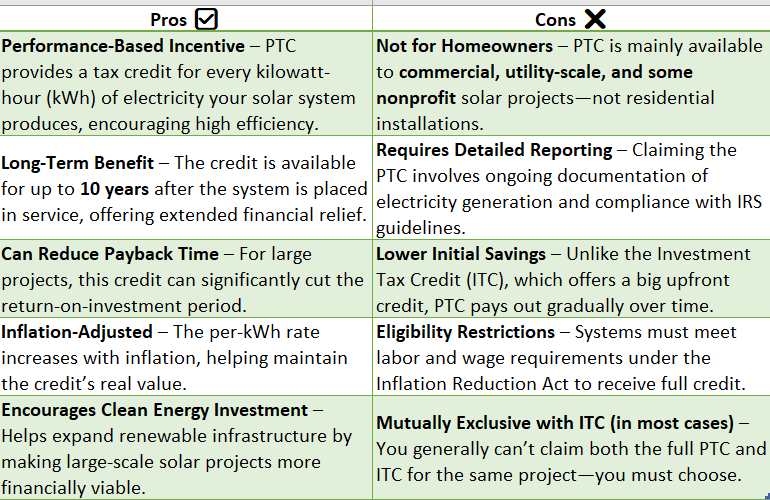

The Production Tax Credit (PTC) is a notable federal incentive for solar energy, offering a per-kilowatt-hour (kWh) tax credit for electricity generated by qualified resources. This performance-based incentive is particularly beneficial for large-scale solar projects, as it rewards higher energy production.

Key Benefits of the Production Tax Credit:

- Encourages increased energy output by rewarding performance.

- Provides long-term financial benefits over a 10-year period.

- Can be combined with other incentives for enhanced savings.

In comparison, the Investment Tax Credit (ITC) offers a one-time tax credit based on the initial installation cost of solar panels. While the ITC provides immediate financial relief, the PTC supports ongoing performance, making it ideal for projects focused on sustained energy output.

Real-world examples demonstrate the PTC’s effectiveness. Large solar farms in states like California and Arizona have utilized the PTC to significantly lower their tax liabilities while advancing sustainable energy production. This approach not only boosts profitability but also aids in reducing carbon emissions.

Ultimately, the choice between the PTC and other solar incentives depends on specific project goals. For those prioritizing long-term energy production and sustainability, the PTC may be the optimal choice for their solar endeavors.

The Future of Production Tax Credit in the Solar Sector

The production tax credit (PTC) has traditionally supported wind energy, but its growing influence in the solar sector is paving the way for significant advancements. Understanding the PTC’s role in solar energy is vital for stakeholders aiming to harness its full potential.

Why is the PTC Important for Solar?

The PTC offers financial incentives that lower the cost of solar projects, making solar power more competitive with conventional energy sources. Key benefits include:

- Cost Reduction: The PTC decreases the overall cost of solar projects, broadening access for consumers and businesses.

- Increased Investment: Tax credits attract investors, fostering innovation and expansion in solar energy.

- Job Creation: As solar projects grow, so do job opportunities in various sectors like manufacturing and installation.

Real-World Impact

A Texas solar farm utilized the PTC to cut initial costs, enabling it to expand and provide clean energy to thousands of homes. This not only increased local employment but also inspired similar initiatives in other states.

Looking Ahead

As solar energy evolves, the PTC’s role is expected to grow. Policymakers are recognizing the need for sustainable energy solutions, and the PTC is crucial in this transition, promoting a shift towards a sustainable and economically viable energy future.

Common Misconceptions About Production Tax Credit Solar Benefits

The production tax credit (PTC) for solar energy is often misunderstood, leading to missed opportunities for homeowners and businesses. Let’s address some common misconceptions to clarify its benefits.

Misconception 1: The PTC is Only for Large Corporations

A prevalent belief is that the PTC is reserved for large corporations with extensive solar farms. In truth, smaller businesses and residential installations can also benefit from these credits, making solar energy more accessible and affordable for a wider audience.

Misconception 2: The PTC is a One-Time Benefit

Contrary to the myth that the PTC is a one-time benefit, it actually provides ongoing support. The credit offers a per-kilowatt-hour (kWh) incentive for electricity generated by qualified energy resources, claimable annually for up to ten years. This structure encourages long-term investment in solar energy.

Misconception 3: The PTC is Difficult to Qualify For

Some believe that qualifying for the PTC is complex. However, the process is relatively straightforward. Key steps include installing a qualified solar energy system, ensuring it generates electricity, and filing the appropriate tax forms with professional assistance.

By dispelling these myths, it’s clear that the PTC is a valuable tool for promoting renewable energy adoption. Understanding its true benefits can help maximize your solar investment, whether you’re a homeowner or a business owner.

Maximizing Savings with Production Tax Credit for Solar Energy

Switching to solar energy is both an environmentally friendly and financially wise choice, largely due to the Production Tax Credit (PTC) for solar energy. This incentive aims to make solar power more accessible and affordable for homeowners and businesses by offering a tax credit based on the electricity generated by your solar system. Essentially, the more energy your system produces, the greater your savings, allowing you to support a greener planet while reducing costs.

Key Benefits of the Production Tax Credit for Solar Energy:

- Cost Savings: Decrease your tax liability, making solar installations more budget-friendly.

- Long-term Investment: Benefit from continuous savings as your solar system generates energy.

- Environmental Impact: Help lower carbon emissions and promote renewable energy.

To maximize the PTC, understanding eligibility and application processes is crucial. The credit typically applies to systems installed and operational by a specific deadline, emphasizing the importance of timing. Seeking advice from a tax professional or solar expert can provide tailored guidance.

Real-world examples illustrate the PTC’s effectiveness. A small business in California, for instance, saved thousands annually on energy bills due to their solar system and the PTC. Such stories underscore the tangible benefits of investing in solar energy. Ultimately, the PTC is a powerful tool for achieving both immediate and long-term financial savings while fostering sustainable energy solutions.

FAQ

-

What is the solar Production Tax Credit (PTC)?

It’s a federal tax credit based on the amount of electricity your solar system generates. -

How is the PTC amount calculated?

You get about 2.75 cents per kWh for electricity produced over 10 years (if wage and labor rules are met). -

Who qualifies for the solar PTC?

Mainly large-scale or commercial solar projects that start construction by set IRS deadlines. -

Can residential solar owners claim the PTC?

No, homeowners typically use the Investment Tax Credit (ITC), not the PTC. -

What’s the difference between PTC and ITC?

PTC rewards energy production; ITC gives a credit based on total system cost.

Don’t wait to go solar! Thousands of homeowners are saving—join them and start reaping the benefits.

Book Your Free Consultation at SOLAR ENERGY

Explore additional solar solutions at NEW SOLAR QUOTES and discover how it can benefit your home!